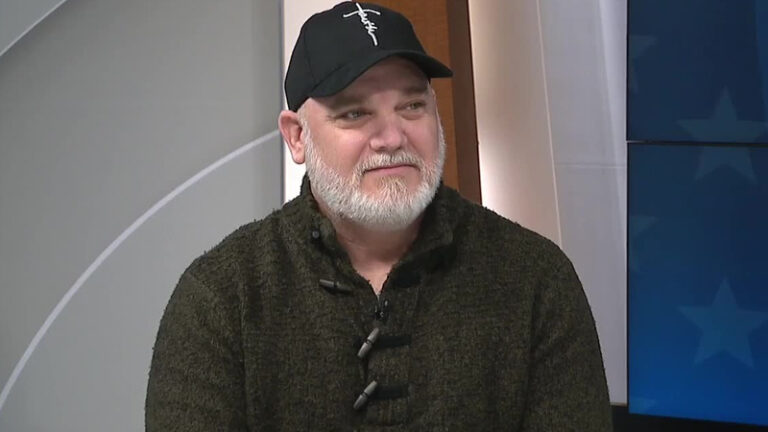

(Photo by KCRG-TV9/Facebook)

Corn and soybean farmers across the U.S. are heading into another difficult growing season as rising farm expenses, low crop prices, and uncertainty around international trade continue to squeeze profits.

For Mark Mueller, president of the Iowa Corn Growers Association and a farmer west of Waverly with three decades of experience, the pressure is already obvious. “My corn and soybeans, I don’t know if I’ll make money on them this year, maybe? I’m hoping I’ll break even,” said Mueller.

Mueller and Iowa State University economist Chad Hart both point to stubbornly high input costs as one of the biggest challenges farmers face. Everything from land rent to fertiliser and seed prices remains expensive, even as farmers earn less for their harvested crops.

“The one-year outlook is still troublesome,” said Hart. Mueller believes part of the problem is that supply companies have not lowered prices even though commodity prices have cooled. He said costs spiked over the past decade, and suppliers are still charging at those inflated levels.

“Everybody is waiting for the other guy, the other supplier, to lower their price first before they’ll lower theirs,” said Mueller. At the same time, farmers are struggling with low crop prices and unstable global demand. U.S. production of both corn and soybeans continues to rise, but access to key export markets has become more uncertain.

Trade tensions have played a major role. A five-month Chinese boycott of U.S. soybeans, triggered by tariff disputes, cut off one of the market’s most valuable buyers. Although China resumed purchases in November, reports showed the total was dramatically lower than the previous year, as China increasingly turns to South American suppliers, Forbes reported.

Brazil has emerged as one of the strongest competitors in the soybean market, partly because its crops are harvested about six months after the U.S. season. That timing gives global buyers more options year-round. As a result, many American soybeans are now sitting in storage waiting for better prices.

Meanwhile, the U.S. Department of Agriculture reported national production hitting a record 53 bushels per acre, while Brazil is also reaching record highs.

Mueller worries that the U.S. is losing its status as the world’s top agricultural supplier. “We used to be everybody’s first choice when they needed to buy grain or meat,” said Mueller. “We’re needlessly shooting ourselves in the foot when we pick fights with our trading partners.“

Even though soybeans are often cheaper to grow than corn, Hart and other economists expect many farmers may shift their focus toward corn in the coming years. Mueller says corn offers greater upside potential.

“The nice thing about corn is there doesn’t seem to be as much of a ceiling on how much revenue I can make,” said Mueller. Overall, optimism is low. Mueller described the outlook as “bleak,” while Hart warned farmers could be headed for a “financial squeeze.”

Still, farmers know the market can change quickly. Weather issues, global shortages, or new trade agreements could push prices higher, as happened in a brief spike in early 2014, when heavy rains in Brazil delayed exports and boosted demand for U.S. soybeans, according to the Bureau of Labor Statistics.

One movement Mueller has participated in is the push for congressional approval of year-round high-ethanol-content gas called E15 – although that legislation has been referred to an ethanol policy council.

He has also travelled internationally, including to India, to explore new export opportunities. “I would much rather have a fair and open and transparent market and so would all of my fellow farmers,” said Mueller.

READ NEXT

Middle-Class America is going Broke under Trump’s Economic Ignorance: ‘This Isn’t What We Voted For’

“I Haven’t Looked Away Since 2019”: Why one Trump voter says he changed